Symptom

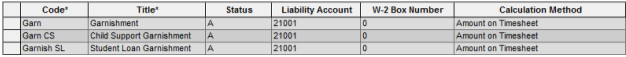

1. Create a new deduction code in Payroll by going to Maintain > Payroll > Deduction Codes and click New.

a. It is recommended to include the phrase "garnishment" or "garnish" or "garn" in the leave code title.

b. Calculation method must be Amount on Timesheet.

2. If additional Garnishment types are required, go to HR > Maintain > Code Table and choose Garnishment Types in the drop down. If not, proceed to Step 4.

3. Add any additional Garnishment Types necessary.

Note: Do not remove or rename type Family from the list.

4. Go to Details > Employee Info and choose the appropriate Employee ID, then go to the Garnishment tab.

5. Choose the Garnishment Type from the drop down, then fill in the other fields based on the garnishment order.

a. If the garnishment is a percentage, check the box "% of Pay".

Note: Do not add the garnishment to the deduction tab of Employee Info, this will cause the deduction amount to be doubled.

6. Garnishments types that are not Family will take up to 25% of disposable income. If an employee has multiple garnishments it may be necessary to specify the order in which income is taken. To do this use the priority level. Example: a Garnishment with Priority level one will be satisfied first, remaining disposable income can be used to satisfy the additional garnishments until the 25% cap is reached.

Note: Garnishment Type Family will take up to 50% of disposable income. If it becomes necessary to deduct more than 50% of disposable income, contact Abila Client Services or your business partner for a custom garnishment script.

Product Line