Answer

Symptom:

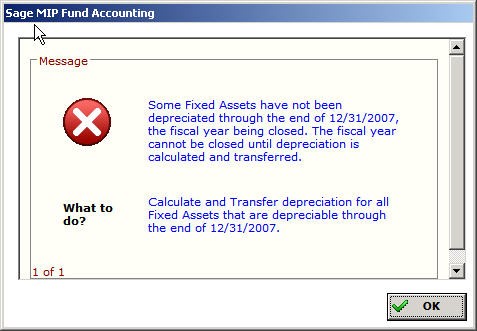

I am attempting to close my fiscal year and note the following error message during the process. How do I proceed with closing my fiscal year?

Message: Some Fixed Assets have not been depreciated through the end of MM/DD/YYYY, the fiscal year being closed. The fiscal year cannot be closed until depreciation is calculated and transferred.

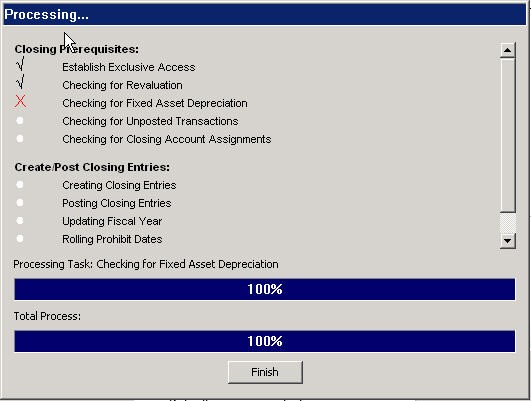

Cause: One or more assets that are Active or Inactive have not had depreciation calculated through the fiscal year end date and have failed the validation check.

The validation is checking three criteria:

-

Is the asset Active or Inactive.

-

Is the Last Depreciation Date less than the Fiscal Year to Close date? If so, is the asset fully depreciated (Accumulated Depreciation = Amount to Depreciate). If not, it will fail the validation.

-

Does the life equal the months depreciated? If they are equal it will pass. If the months depreciated is less than the life it will fail the validation.

Resolution:

There are several resolutions available depending on the condition of the asset.

First you must find the asset(s) causing the issue.

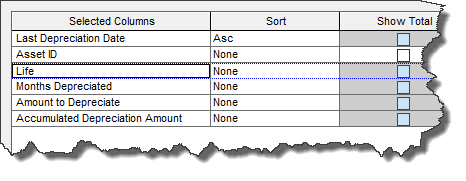

This is best done with an Asset List Report (Reports>Fixed Assets>Assets)

On the Content tab put the following fields.

On the Filter Tab Filter for Status <> D

This allows you to see the last depreication date of the asset as well as the life vs months depreciated and amount to depreciate vs accumlated depreciation amount.

What to look for:

The most common thing to look for is for an asset that still have depreciation (both life and amounts) to be taken on it. This happens if the depreciation for the asset is skipped for whatever reason. The best solution for this is to simply calculate depreciation up to the last day of the fiscal year that needs to be closed. Transfer it to accounting and that will resolve the issue.

Question: The fiscal year with the untaken depreciation has been audited and cannot be changed. Is there a way to take that depreciation without changing the values in that year?

Answer: No, you cannot skip depreciation. If this is the case, then you will need to change the values on the Depreciation Tab of the asset.

If Life is Greater than Months depreciated –

Change the life of the asset to be equal to the months depreciated. This will have no effect on amounts or future calculations or accounting entries.

If the Amount to Depreciate is greater than Accumulated depreciation amount –

Two Options:

-

Change the amount to depreciate to be equal to the accumulated depreciation amount. When the asset is disposed this reduced value is what will be removed from your asset account.

-

Enter the Difference as a salvage value. When the asset is disposed this amount will be booked to the gain/loss account.

Question: Can I just change the status of the asset to fix this?

Answer: No. Changing the status of the asset to Inactive will not resolve this problem. Changing the status of the asset to Discontinued will solve the problem but after you close the fiscal year you will never be able to modify or dispose of the asset. Not recommended.

Question: The asset is fully depreciated (Cost = Amount to Depreciate) but still show that there is life left. Is this a problem?

Answer: No. Due to the way the asset was set up or rounding it can sometimes run out of $ to depreciated before it runs out of months to depreciate. In this case just set the Life = Months Depreciated.

Question: The asset is fully depreciated (Life = Months Depreciated) but it still shows a small amount of $ left to depreciate. Is this a problem?

Answer: No. Due to the way the asset was set up or rounding it can sometimes have a small amount of $ left to depreciate when the Life = Months Depreciated. To fix this either set the Cost of the Asset = Accumulated Depreciation amount or put the difference in Salvage Value.

Article Type

Product Info

Product Line

MIP Fund Accounting

MIP Cloud/Login.mip.com

Product Module/Feature

Fixed Assets

Product Version

2021.1.0

2020.3.3.0

2020.3.1.0

2020.3.0.1

2020.3

2020.2

2020.1.4

2020.1.2

2020.1.1

2020.1.0

2020.1

2019.3.1

2019.3

2019.2

2019.2.0.1

2019.1.4

2019.1.3

2019.1.2

2019.1.1

2019.1

2018.1.6

2018.1.5

2018.1.4

2018.1.3

2018.1.2

2018.1.1

2018.1

Ranking