Answer

The Summary Asset Ledger and the General Ledger are the best reports to use to tie Asset to GL amounts. Prior to 15.x there were issues with the Summary Asset Ledger that reduced its effectiveness. Most of these issues have been resolved. The majority of this article discusses how to tie the Accumulated Depreciation.

For details on tying the asset account see the Additional Information section.

The Summary Asset Ledger:

Reports>Fixed Assets>Summary Asset Ledger

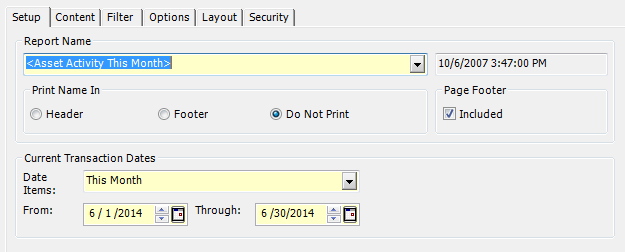

Setup Tab

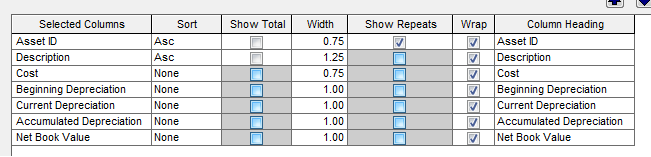

Content Tab:

Filter Tab:

You would want to filter on just criteria that is going to the asset account in question. If that is not possible (you have mutliple assets hitting an account and you can’t distinguish them in the filters) then you won’t be able to tie to a specific GL account, only all your asset accounts.

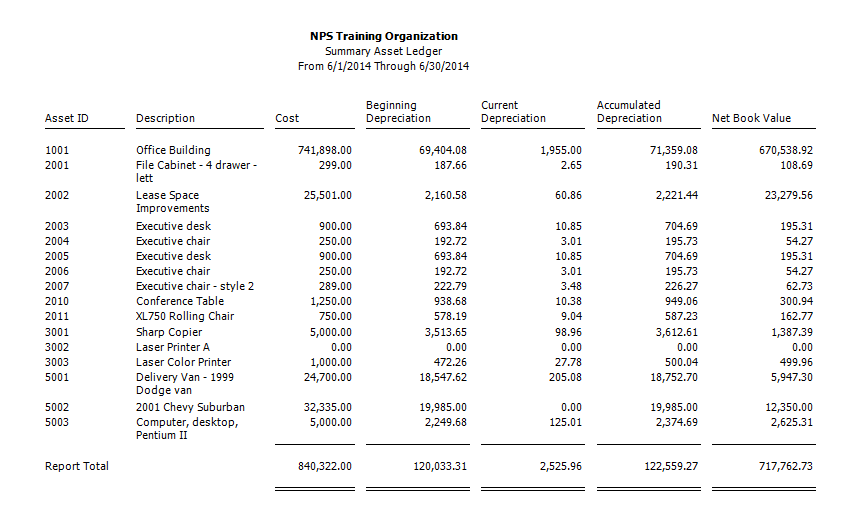

Run the Report and you will get a list of the values in the Fixed Asset System

The Expanded GL Report:

For the ledger side of the reporting create an Expanded General Ledger.

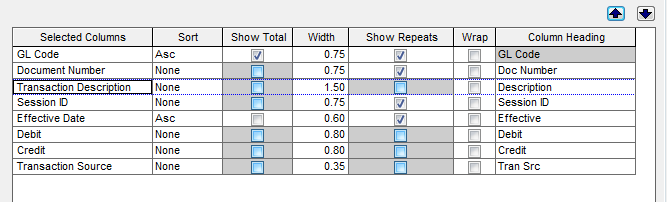

Content Tab:

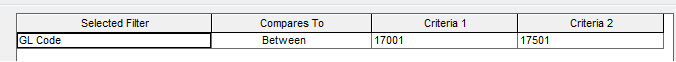

Filter Tab:

You would want to filter on the GL Codes that correspond with the ones used by your assets in the Summary Asset Ledger.

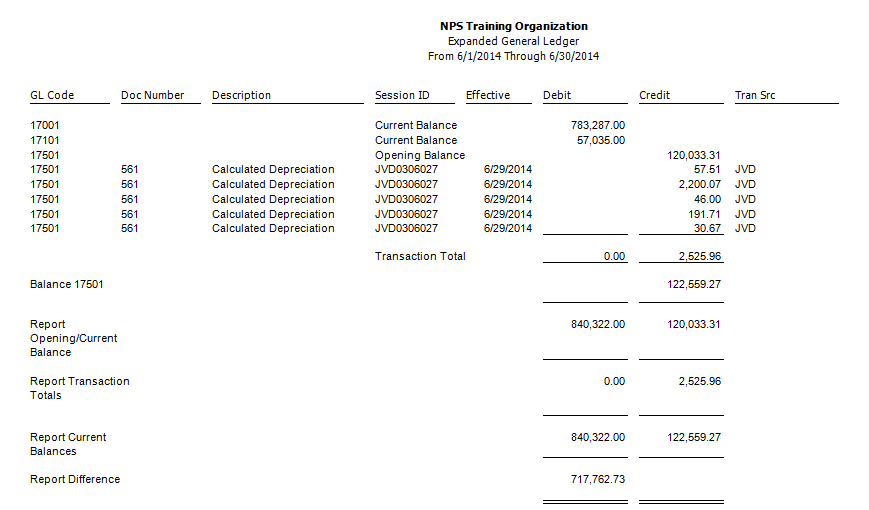

Results:

You should be able to tie values from the Summary Asset ledger to the different values on the General Ledger.

Effect of Disposals:

One common question about these two reports is the effect of disposals on the reporting.

When you do a full disposal (not partial) of an asset and run the report including the period of the disposal it will remove all information from the asset on the Summary Asset Leger. The beginning deprecation and current deprecation will be $0. This will be true even if at the beginning of the report there was beginning depreciation and if for the period of the report there was deprecation.

EXAMPLE: An asset that cost $36K with a life of 36 months that goes into service on 1/1/00. It depreciates $1K month until 12/31/03 and then is disposed on 12/31/03. If you run the Summary Asset Leger for 1/1/03 to 11/30/03 it will show a begin depreciation of $24K and a current depreciation of 11K and a disposed deprecation of $0. If you then run it for 1/1/03 to 12/31/03 the begin deprecation will drop to $0, the current depreciation will drop to $0 and the disposed depreciation will be $36K.

If you were to run the GL for the same periods the 1/1/03 to 11/30/03 would show a beginning balance of $24K, current activity of $11K. If you run it from 1/1/03 to 12/31/03 you will show a beginning balance of $24K, current activity of $12K and then a disposal of -$36K.

Question:

I have run the two reports and the totals do not tie. Why?

There can be several reasons that the totals do not tie:

-

The reports are not set up correctly and looking at the same information for the same time period.

-

Incorrect balances entered as the beginning balances in the GL when the database was set up.

-

Incorrect balances entered for an asset when an asset was put into the GL. Adding the asset to the fixed asset module DOES NOT have any effect on the GL. When assets are added to the fixed asset system it is assumed an additional accounting entry is done to establish their asset balance in GL.

-

Incorrect balances entered for the historical depreciation in fixed assets. When an asset that already has deprecation on it is entered into the system amounts must be put into the historical depreciation. This amount could have been incorrect.

-

Additional adjustment done to the JV but not to fixed assets. Look for transactions that have an transaction entry source of something other than JVD (usually JV). These are adjustments that affect the GL balance that do not affect assets.

-

Depreciation in the GL is including assets that you are not expecting. Make sure the GL includes transaction description. This will show which assets the depreciation as long as the transfer was in detail. If the transfer was in summary you will not be able to find out where it came from.

-

The summary asset ledger is filtered for assets that were not included in the depreciation. This is most commonly because the coding or classification of the asset was changed after depreciation was done. Thus it is being pulling in with assets that it was not always associated with.

-

A defect that caused the double or triple transfer of assets to GL. This can be found by looking for multiple document numbers for the same asset with the same effective date in the GL. Data repair is required to fix this.

-

A defect exists (still as of 15.2, FA-14160) that causes any asset that has had a partial disposal to report incorrect accumulated depreciation on the Summary Asset ledger.

-

A defect exists (as of 15.2) that causes assets that have been entered with historical deprecation to not show up on the summary asset ledger of no system generated deprecation has been taken in the system. The historical accumulated depreciation will not show up until the assets have depreciation transferred through the system.

Additional Information

Tying the Asset Account:

When fixed assets are entered into the MIP system two things happen. The asset is keyed into the fixed asset module with a cost.

An independent transaction is done to record the value of that asset in the asset account.

There is no link between these two transactions. It is very possible to create a group of assets that have a value of $10K in the asset module but accidentally record them with a value of $11K in the GL. There is no report that is going to easily point this out or tie it to errors on a specific asset.

Depreciation does not affect the value of the asset account. It should retain the entire value of the asset (and be increased by any additional assets added to the system) until a disposal is done. At the time of disposal the values in the asset are diminished.

It may help to run a Asset List Report (Reports>Fixed Assets>Assets) and compare it against the summary asset ledger run through todays date. They should return similar values for the cost.

When troubleshooting improper balances in the asset account one of the first things to look at is if there is any type of unusual JV done. A JV to the account can throw the balances off.

Another common issue when trying to tie the asset accounts is to be careful of what you are filtering on. Usually a category of assets is associated with a specific GL account. But sometimes other assets might also use that account. When running the summary asset ledger or the asset list report be sure to include Asset Account in the body and see if there are any unexpected values.

NOTE: If change the asset account associated with an asset and then run the summary asset ledger or asset list report the ENTIRE cost will be associated with the current entry. It will not break it down or have any association to the old account. Therefore it is possible to have done the accounting entry for one GL account but have the asset value show up in another.

Article Type

Product Info

Product Line

MIP Fund Accounting

Product Module/Feature

Fixed Assets

Ranking