Symptom

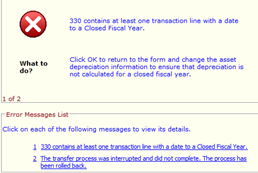

Attempting to transfer Fixed Asset Depreciation to Accounting but getting an error message:

### contains at least one transaction line with a date to a Closed Fiscal Year.

NOTE: the ### at the beginning of the error message doesn’t necessarily correspond to an Asset ID. This is the document number it would be using that would contain the prior year entries.

Cause

There is an asset in the calculation that contains depreciation that was calculated in a fiscal year that is already closed in MIP. Most of the time these are new assets that have been set up since the last time depreciation was taken and they have a beginning deprecation date in a prior closed fiscal year. As a result, it is trying to take depreciation in those closed fiscal years.

Resolution

To resolve this, you will need to find the asset that has the issue. Delete the calculated depreciation and adjust the asset so it no longer causes the problem.

1 – Finding the Asset

To find the asset(s) causing the problem go to Reports>Fixed Assets>Depreciation Calculation. Create a new report.

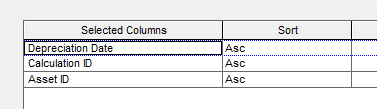

On the content tab put the following in Report Body. Depreciation Date, Calculation ID, Asset ID.

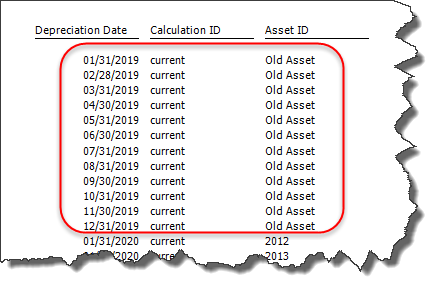

Print the report to screen. You will see a list all the depreciation of the assets in chronological order. Look for those assets who have a depreciation date in a closed fiscal year.

2 – Delete the calculated depreciation

Go to Activities>Fixed Assets>Calculate Depreciation.

Pull up the Calculation ID that contains the problem assets and then click the Red X delete button down at the bottom.

Choose to delete Calculated Depreciation Only.

3 – Fix the Asset

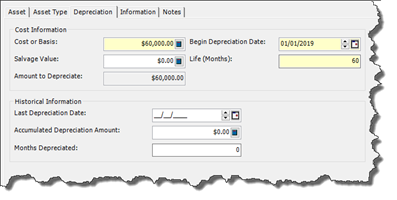

Go to Maintain>Assets and pull up the Asset ID that is having problems.

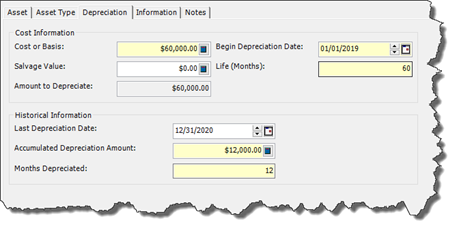

Go to the Depreciation Tab. You will likely see that the Historical information is blank or has a last depreciation date value that is in a closed fiscal year.

In order to resolve this issue, you have to have the last depreciation date on or after the last day of the last fiscal year that was closed in the system. In this example it is 12/31/2020.

If you have not done so already you would want to make sure that accounting entries were made to support this historical information. In this case you would book depreciation expense and accumulated depreciation to the ledgers. Since 12/31/2020 is in a closed fiscal year consider putting it as an opening entry on 1/1/2021.

In many cases where “old” assets are just being moved into MIP the depreciation for them has already been entered into the accounting side, if that is the case no entry is needed.

If the “old” asset is fully depreciated, then you would update the historical information to reflect that it is fully depreciated.

After the asset is updated, you should be able to go back and calculate depreciation and not have the issue when you do the transfer.

Article Type

Product Info

Product Line

MIP Fund Accounting

Product Module/Feature

Fixed Assets

Product Version

2022.1

Ranking