Symptom

Social Security Earnings for people who have reached the Maximum Social Security Earnings are incorrect. It maxed out at the prior years amount, not the current years amount.

Cause

The tax tables for the current year were not in place at the time that employee reached their Social Security Maximum.

Possible Causes of this are:

-

The tax update was never installed. Tax updates are issued in the December/January timeframe of every year and need to be installed on each workstation. Additional updates are released throughout the year.

-

The tax update was installed but it did not install correctly. After installing the tax update it is important to check the file dates listed in the documentation to make sure the proper files got updated. If they did not then the tax tables were not updated even though it may say that the update installed successfully.

-

The tax update was installed but at some point during the year the workstation was uninstalled and reinstalled. When it was reinstalled the tax update was not re-applied. If you reinstall the software it’s important to do the tax update as well.

Resolution

To resolve this issue do the following:

-

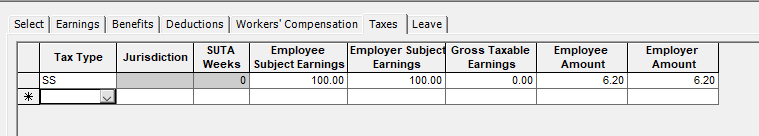

Go into Setup/Adjust Employee Balances and increase the Employee Subject Earnings, Employer Subject Earnings and the Employee and Employer Amounts for FICA Taxes.

Example:

-

Go into accounting and do a JV to cover the differences. You may need to adjust your Tax Expense and Liabilities account by the differences in the amount of taxes that should have been paid/withheld.

-

Since not enough FICA Tax has been withheld from the employee you will need to decide about how to handle that and if the employee is going to return the money that should have been withheld.

It is advisable to check the dates of the installed files against the information provided in the Knowledge base article that you downloaded the tax update from and make sure that they are correct.

NOTE: Starting with Version 20.2 all on premise customers will receive tax updates via the Workstation Update Tool vs having to manually copy them.

https://kb.communitybrands.com/article/using-mip-workstation-update-tool

If you are not familiar with the Workstation Updater Tool you should review that KB for instructions on how to run it and confirm that the files were updated.

Article Type

Product Info

Product Line

MIP Fund Accounting

Product Module/Feature

Payroll

Product Version

2021.2

2021.1.2

2021.1.1

2021.1.0

2020.3.3.0

Ranking