Answer

Starting January 1, 2020 Payroll Taxes have had a significant change due to a Revised W4 form. Rates, filing status options and exemptions have all changed as well as a change in methodology in the calculation itself. As a result, Tax amounts may vary in unexpected ways. This is not because of any issues or errors with the program but because of the inputs involved and changes to the tax settings.

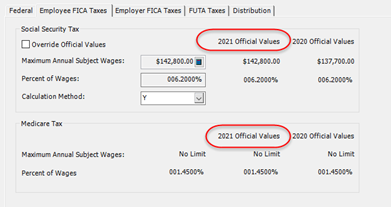

When verifying your Tax calculation, it is first very important to make sure you are on the current version. The Tax updates to the current version are usually released the last week of December to the first week of January. This is usually a .dll file that must be manually installed to each workstation. The easiest way to determine if you have the correct tax tables is to go to Maintain>Payroll>Federal Taxes and go to the Employee FICA tab. Once there see if the current year official amounts are listed.

If they are not, then you will need to get the update installed. If you have any questions about what version, you should be on for the tax update to work contact support.

NOTE: MIP hosted customers (Single and Multitenant) will automatically have their tax updates applied during the 1st week of January.

If you have verified the version, you are on the next step is to calculate but not print a payroll. Troubleshooting should be done from a calculated, but not printed payroll. The reason for this is that after the checks have been printed it is impossible to verify the settings and options that were used in the calculation. You also cannot adjust settings and verify that those will resolve the issue.

With a calculated but unprinted payroll go to Activities>Payroll>Review/Modify Calculated Payroll. Pull up the payroll for the Employee in question. Then go to the Taxes Tab. Do NOT look at the earnings tab. The earnings tab is Gross Pay and not affected by deductions. You MUST look on the Taxes tab.

On the Taxes Tab and look at the FIT line. The first thing to look at is the Employee Subject Earnings. Note this amount. This is the amount that MIP is calculating taxes on. Many times, it is discovered that this amount is not what is expected.

The value here is equal to sum of the Taxable Earning Codes minus the sum of the Deduction Codes that decrease FIT subject earnings and then adding in any Benefit Codes that increase taxable earnings (if any). If this amount is incorrect then you need to examine the Earnings, Benefits and Deduction Codes used on the payroll and their tax consequences.

Once those codes are correct delete the calculated payroll (click the delete button down on the bottom of the Review/Modify Calculated Payroll). Then fix the timesheet if needed and recalculate. Go back into Review/Modify and check to see the subject earnings are correct.

If the subject earnings are correct but the tax amounts are still not what is expected, then do the following.

Go to the following IRS link. It is updated each year.

https://www.irs.gov/pub/irs-pdf/p15t.pdf

Scroll down to Page 8, this contains a worksheet to check the calculation with. The tables that are used are on Page 10.

Before starting on the process, it helps to gather some information.

Go to Maintain>Employee>Employee Information.

Pull up the employee and collect the following information:

On the Job and Pay Tab what processing group they belong to. From this you can find out how many payrolls they have each year. If you know the number of payrolls for that group, you can skip this.

-On the Federal Tax Tab take note of

Filing Status

If the Exempt from Withholding is checked

If the Employee completed W4 prior to 2020 is checked.

Depending on the results of the Employee completed W4 prior to 2020 you will have either the W4 prior to 2020 or W4 2020 and Forward options available.

If you have W4 prior to 2020 note the number of withholding allowances and amount of additional withholding.

If the W4 2020 and forward is checked not the amounts in each box and if the multiple jobs are checked.

NOTE: If the Exempt from withholding is checked no Tax will be calculated under any scenario, even if there are amounts in additional withholding.

Go to Page 8 of the referenced form. There is a worksheet there. Print it out and use the information gathered above to fill into it.

There are some important things to note about this worksheet

In Step 1 there is a different process and part to fill in depending of if you are using the 2019 and before W4 or 2020 and Later W4 standards.

If you are using the 2019 and before you will be skipping Box 1D-I and filling out 1 J-L by multiplying the number of withholding allowances by $4300.

If you are using the 2020 or later W4 form you will be using Line 1D-I. Pay attention in line 1G, they are asking if the Multiple jobs box is checked. If it is then note the amounts you will enter into the boxes.

After you have filled out the appropriate boxes in Step 1 you will be using Step 2 and referencing the tables.

Things to note on the tables

If you are using the 2019 and before W4 method OR you are using the 2020 and later and DO NOT have the Multiple Jobs box checked then you use the Standard Withholding Rates schedule.

If you are using the 2020 and later W4 method without the Multiple Jobs Box checked use Form W-4, Step 2, Checkbox Withholding rate schedule.

Notes on W4 information

Regardless of the method the Additional Tax Withheld is a PER PAY PERIOD amount. This should not be divided or multiplied by any number but added to the calculated tax withheld at the end of the process.

The new fields on the 2020 and later W4 are ANNUAL amounts. You should put in the amount of ANNUAL wages that go into those options. Do not put in the per pay period amount.

If you calculate the amounts according to the worksheet the number that you arrive at should be very close to what MIP calculates. The amount of rounding difference is higher than previous years due to the annualized method of calculation and could be close to a dollar.

Article Type

Product Info

Product Line

MIP Fund Accounting

Product Module/Feature

Payroll

Product Version

2020.1.1

Ranking