Answer

There are two ways to record a prepayment/credit in AR. A/R prepayments and Negative A/R invoices.

In both cases these instructions are for recording the receipt of a payment against future charges for which an invoice does not exist at the time of recording. If the invoice exists but the amount of the payment is greater that is an overpayment.

https://kb.communitybrands.com/article/faq-how-handle-ar-overpayments

Using A/R Prepayments

The recommended way to record prepayment is to use the A/R prepayment function within the A/R Receipt Transactions.

-

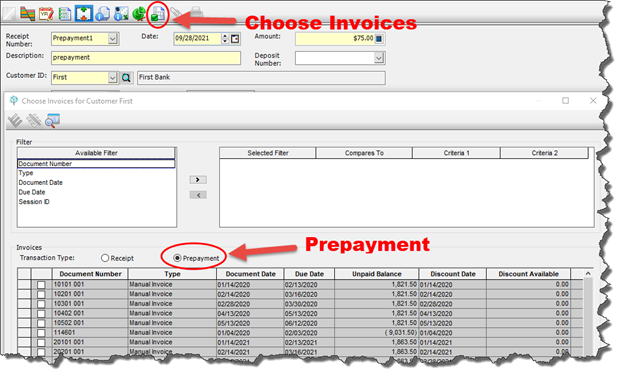

Go to Transactions>Accounts Receivable>Enter A/R Receipts.

-

Start a new session.

-

In the Receipt number make up a document number or use the check number that you receive the payment .

-

Fill in the document information. After you select the Customer ID a window should pop up showing all outstanding Invoices. If it does no you can click the Choose Invoices button.

-

On the popup screen select the prepayment option.

-

Then enter the coding to the prepayment. In most cases you are hitting A/R and Cash.

-

Save and post the entry.

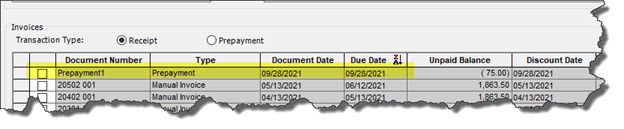

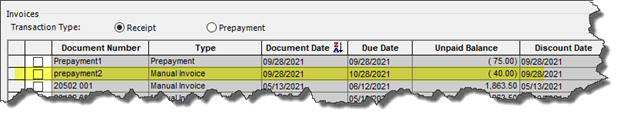

In the future when you go to enter A/R Receipts for that Customer and the Choose Invoices screen pops up you will see that prepayment available to select in conjunction with a positive invoice.

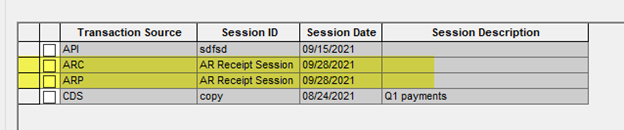

NOTE: When an A/R Receipt Session is created it will show up twice in the post transactions screen. Once as a ARC (Receipts) and as a ARP (Prepayments).

This is because the system is reserving that Session ID in both transaction sources for use. If both Receipts and Prepayments are not used in the session it will drop the unused line when the session is saved. It will only post what was entered.

Using Negative A/R Invoices

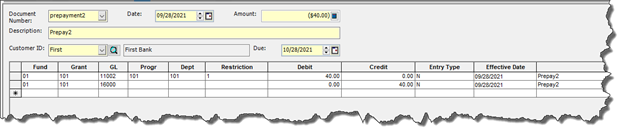

It is recommended to use the A/R Prepayments to record these transactions, but it is also possible to use a negative A/R Invoice

In this case you would create an A/R Invoice session and document like you normally would. When entering the debits and credits you would enter them the same way as you would the prepayment.

When you enter Receipts, you will see this as a negative line.

Question: What if I have already recorded the check as a Cash Receipt or JV? Would I still follow the same process?

Answer: If you want to receipt to show up in A/R and be available to match against future invoices you would still have to go through this process. When recording it instead of hitting A/R and Cash you would hit A/R and the other account that you offset the Cash against when you recorded the check (usually Revenue).

Question: What if I want to match this prepayment against an existing invoice?

Answer: If you have an existing invoice to match it against you don’t have to go through the prepayment process. You can just handle it as a normal AR Receipt.

Question: Can I use an A/R Credit to create a prepayment?

Answer: No. A/R Credits are designed to be matched against existing invoices, not create new items.

Article Type

Product Info

Product Line

MIP Fund Accounting

Product Module/Feature

Accounts Receivable Billing

Product Version

2021.1.2

2021.1.1

2021.1.0

2020.3.3.0

2020.3.1.0

2020.3.0.1

2020.3

2020.2

2020.1.4

2020.1.2

2020.1.1

2020.1.0

2020.1

Ranking