Answer

-

Before you begin, you will want to gather the session ID of the JV you wish to reverse.

-

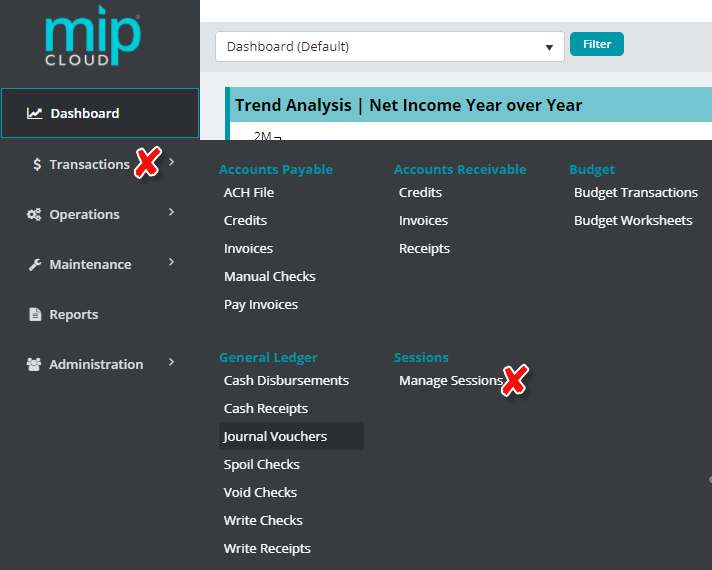

On the side menu bar, choose Transactions> Manage Sessions.

-

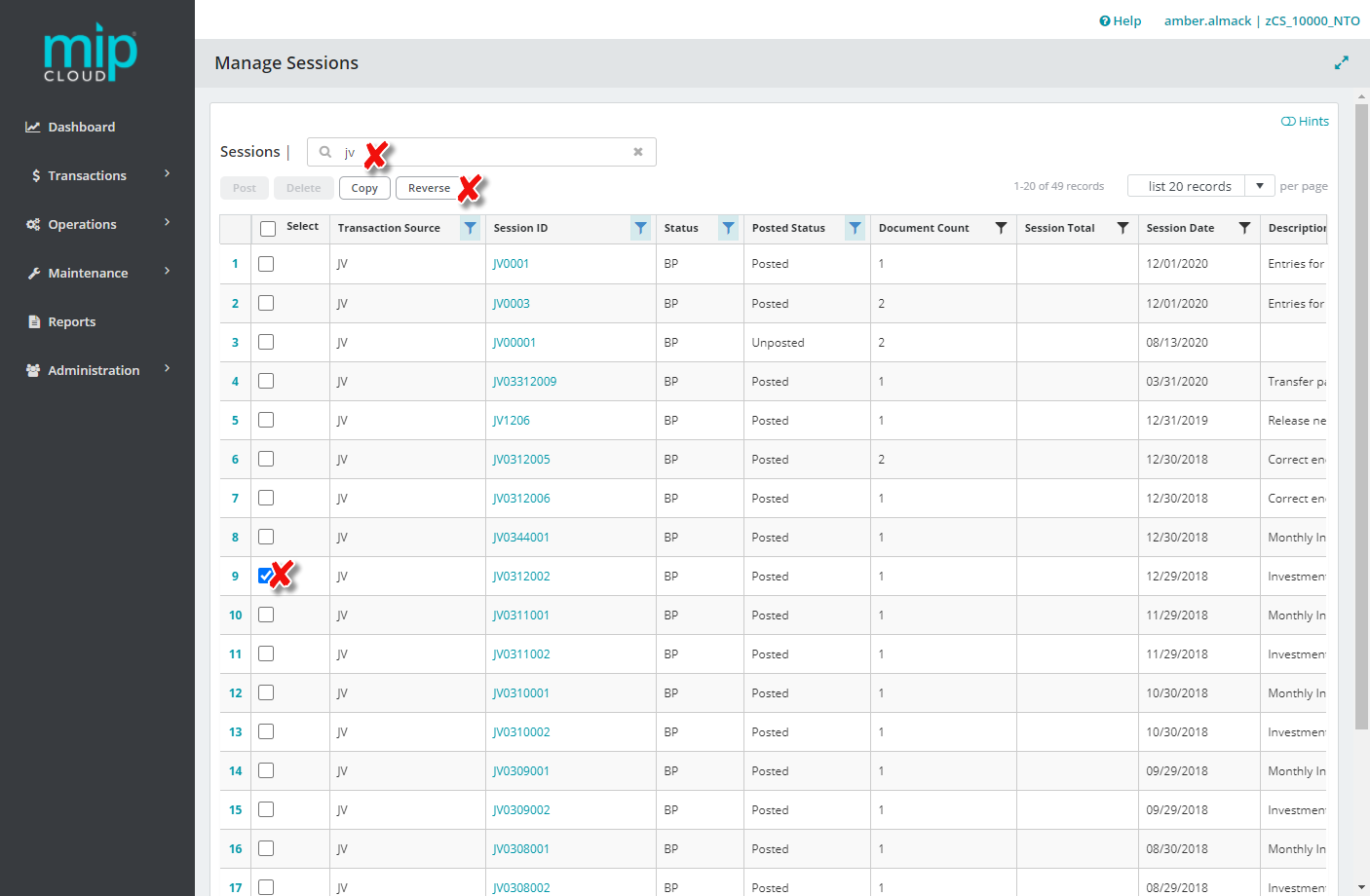

In the next screen, in the field Sessions: type in the JV Session ID of the session you wish to reverse.

-

Choose the JV session from the list by selecting the box on the left.

-

Hit the Reverse button that is below the Session Search bar.

-

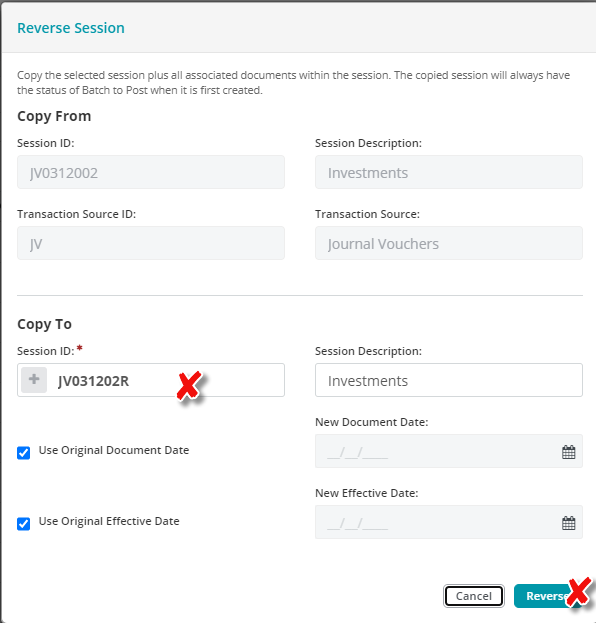

A new screen will appear. This is where you will enter an original session ID for the reversal of your JV session.

-

The only time the effective date of your original document and the effective date of the reversal document should be different is when the original accounting period is already closed. An example of this might be the case of a year-end or month-end accrual entry for which you want the reversal to be effective in a new accounting period. In that case, you would uncheck Use Original Effective Date and enter a new effective date of your choice.

-

Update the new Document Description to indicate this is a reversal.

-

Click Reverse to complete the reversal process.

-

You will get a message at the top of your screen, letting you know the reversal is successful.

-

Your session ID will now appear on the list and you can check it select it by checking the box, and then choose Post, to post the reversed session.

Article Type

Product Info

Product Line

MIP Fund Accounting

Product Module/Feature

-None-

Ranking