Answer

PA has a complicated local tax situation. The state is divided up into Tax Control Districts (TCD’s) of which there are dozens. Different employees can be in different TCDs. But you don’t necessarily report or pay the TCD the employee is in.

Rather, it is the TCD the employer is in or some other TCD.

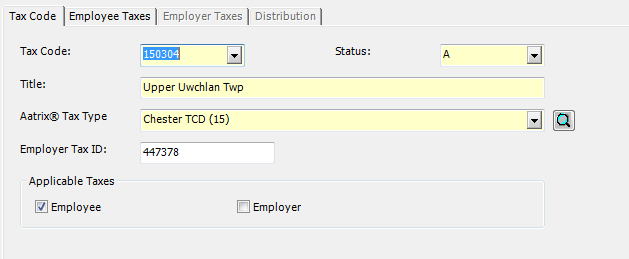

Each of the local withholding Taxes codes in MIP can be tagged for a TCD code. You may have to hit the Find button next to Aatrix Tax Type to select the code in question.

When this is done the code will pull into the Aatrix grid

However there is an overide. In the Aatrix wizard there is a question about PA Act 32.

If either of the first two options is selected, the system will automatically consolidate the information for the different TCD’s into the specified TCD. So even if someone is tagged for TCD 46 if the TCA specified is 23 they will be pulled into 23.

If you select the last option, you will have to fill in the information for all the Tax Collection Authorities (TCA’s) individually.

Article Type

Product Info

Product Line

MIP Fund Accounting

Product Module/Feature

Payroll

Ranking