Answer

Deposit numbers are a useful tool when processing receipts in the software and reconciling them using the Bank Reconciliation Module.

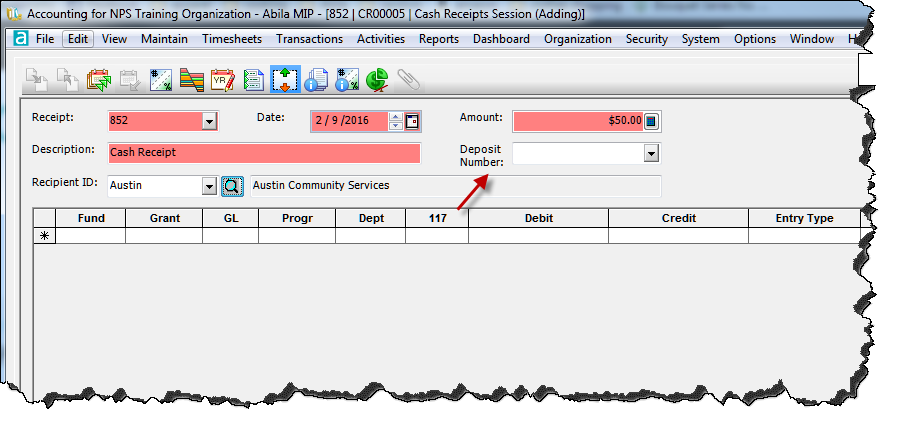

When entering a Cash Receipt or an Accounts Receivable Receipt or a Receipt Writing Session, you are given the option to enter a deposit number:

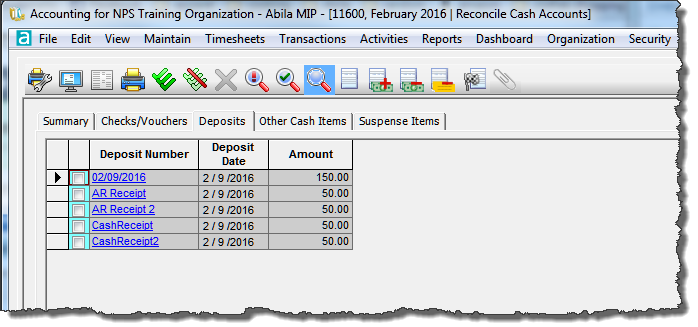

If you leave this area blank, the software will default the deposit number to the Document Date of the transaction, which you can see after posting the transaction:

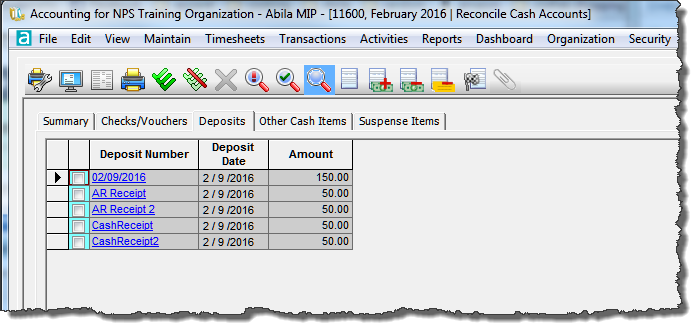

Note that Deposit Number 02/09/2016 shows as $150.00 but the one cash receipt (# 852) that was posted in the previous image for $50.00 is not seen.

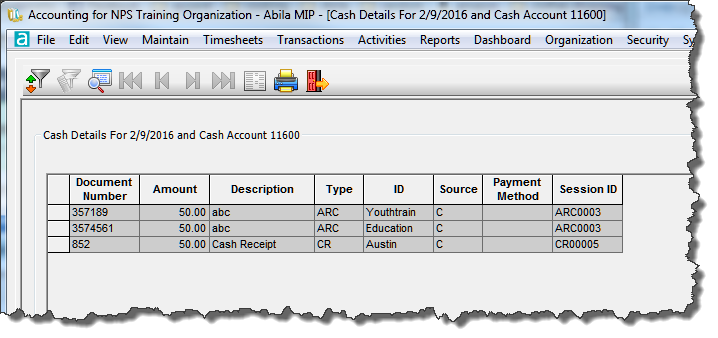

To see the listing for that receipt, double click on the 02/09/2016 Deposit Number hyperlink and all of the transactions for that day that were entered without Deposit Numbers are listed:

The Deposit includes Type ARC (Accounts Receivable Receipt) and CR (Cash Receipt), and will also show CRS (Receipt Writing Session) transactions. This is because they were all entered with dates of 02/09/2016 with no Deposit Number entered.

These deposits will have to be cleared at the same time. There is no way to clear an individual receipt from this deposit number, 02/09/2016.

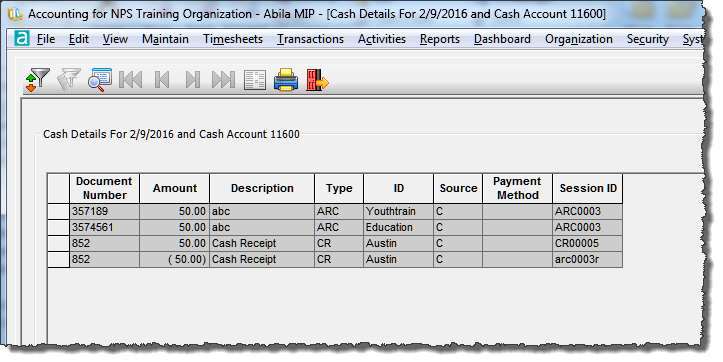

If you would like to separate them after they have posted you would need to reverse the transaction using all original dates and then copy it adding a unique deposit number to each receipt. You will see that the initial deposit and the reverse will net out, as seen here using receipt 852 as an example:

When you provide a deposit number for each transaction, in Bank Reconciliation each document shows up separately, as seen in all the items below Deposit Number 02/09/2016 here:

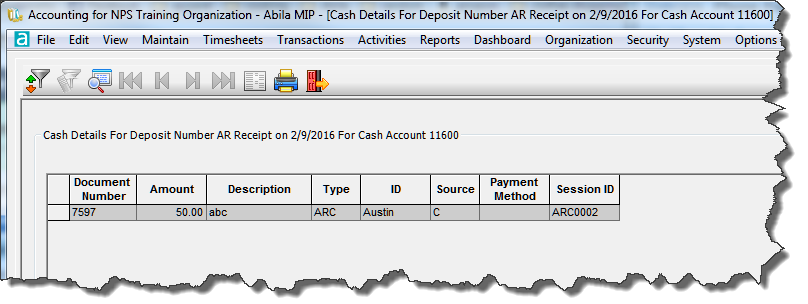

When you double click on deposit number “AR Receipt” here are the results:

Document numbers can be all numeric, alphanumeric or alphabetical but do not use special characters (!@#$%^&*/+) etc. as they can cause errors in the software.

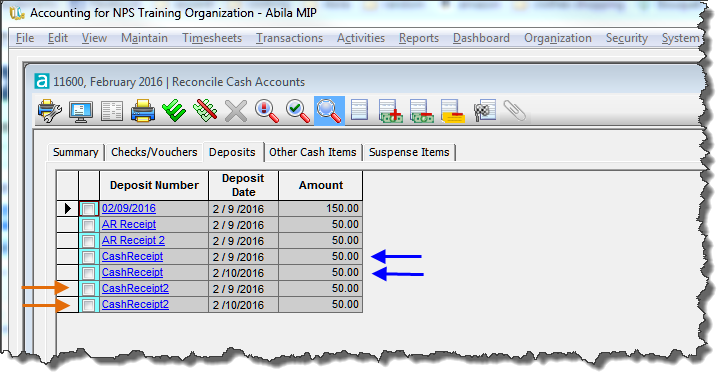

In addition, if you use the same deposit number with different document dates, the Bank Reconciliation will show them as different line items. This can make your bank reconciling process more difficult:

Our recommendation is to use unique deposit numbers when entering them manually.

Article Type

Product Info

Product Line

MIP Fund Accounting

Product Module/Feature

Bank Reconcilliation

Ranking